The Cross-Chain Roundup #12

Week Roundup (February 6 - 12, 2023)

Welcome to the most exciting cross-chain roundup of the year so far. This was the week when Bitcoin finally became interoperable and joined the cross-chain party that’s been unfolding across EVM networks for years. That’s right, we’re talking Ordinals, the NFT craze that filled Bitcoin blocks to bursting point and sent floor prices soaring. If minting NFTs on Bitcoin just to sell them on OpenSea isn’t peak cross-chain, what is?

Well, we do have some more practical suggestions actually. The sort that might not make their early adopters rich but that is arguably doing more to expand blockchain utility, interoperability, and price efficiency. As always, we’ll detail the most essential of these stories below together with a selection of other news that gripped the cryptosphere this week. We’ve also got some fascinating long reads in the latter half of this dispatch for anyone with the patience to dive deeper.

📰Cross-Chain Updates

There are some fees you want to stay low: base layer fees primarily. And there are others – i.e. protocol fees – that you want to rise because they’re indicative of robust usage and a healthy ecosystem. Thus, the news that fees for Arbitrum derivatives protocol GMX are at an all-time high is to be celebrated. GMX has now accrued over $5.5M in fees.

The SEC, led by the much-maligned Gary Gensler, has been bumping its gums again and rubbing everyone in the industry up the wrong way. While Kraken, which got hit with a $30M fine for “staking violations” is the primary victim here, the crackdown has broader repercussions. It’s actually bullish for liquid staking derivatives that are settled onchain but bearish for US exchanges. The Kraken debacle, followed by rumors of the SEC coming after Paxos next, has prompted bitter claims that the agency is “extorting everyone.”

The biggest story this week was of course the first great tragedy of 2023: the Turkish and Syrian earthquake that’s claimed over 20,000 lives. Ever quick to respond, the crypto industry rallied and set up a relief fund to raise money for those affected by the disaster. Avalanche, Polygon and Polkadot were among a string of blockchain projects to declare their support.

Caddi has released a Chrome extension for optimal order routing that promises to save money on every trade. It picks up the transaction you’re scanning, figures out the asset being traded and its associated price with fees. It then queries APIs for different exchanges as well as DEX aggregators. If the quoted price is better than the price you were originally trading at, Caddi will suggest these routes to trade at.

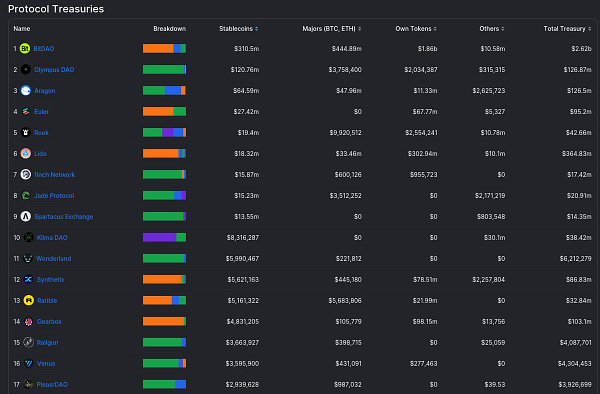

The ever-industrious team at DefiLlama is back with another useful dashboard. Its treasury dash details the assets held in reserve by blockchain projects. It also breaks down their funds by asset type, providing an insight into their runway and fiscal policy.

Clearpool Prime, a non-custodial, institutional-grade marketplace connected to a KYC & AML compliant network, is open for signups on Polygon. The platform will support wholesale borrowing and lending of digital assets and is designed for institutions seeking exposure to DeFi without the downsides. It promises deep liquidity, efficient pricing, and minimized contract risk.

Last week, we were talking about how you’ll be seeing zk proofs everywhere this year. This week, we’re talking about Binance’s efforts to incorporate them into its Proof of Reserves program. This enables the exchange to provide verifiable proof of the assets it holds without disclosing sensitive financial data.

SushiSwap is pressing ahead with its plans to roll out a derivatives platform. Rather than build one from scratch, however, it’s decided to purchase Vortex. Built atop Sei Network, a blockchain using Cosmos’ tooling, the on-chain trading platform will come under the SushiSwap umbrella as another product and will take a new name.

📊Bridge Stats

Top Protocols with the most TVL (7 Days) 👉 Lido ~$7.93B

📜Interesting Reads

The Multi-Chain Is Now Timeless: Introducing Future-Proof Interoperability

Operation Choke Point 2.0 Is Underway, And Crypto Is In Its Crosshairs

How General Message Passing is Revolutionizing the Blockchain Landscape

🐦Twitter Spaces

👨💻 Get Started with Swing Today

📓 Learn more about Swing:

Website |Widget| Docs |Developers Hub

👥 Join the community: